This story is part of our Multiply Her Power series. Learn how you can invest in women and watch your gift transform entire communities.

The challenge: 1.4 billion people excluded from finance

Today, one in six people worldwide don’t have access to financial services. Many of them are women living in poverty. They are juggling risks and crises and often have unpredictable incomes. Because they are excluded from banks and denied credit, they get stuck in the poverty trap.

That’s why BRAC was one of the pioneers in microfinance in 1973 in Bangladesh. At the time, traditional banks refused to lend to the rural poor. People who needed a loan as small as $20 found the doors of every financial institution closed to them. Women faced the highest barriers of all. They could not open accounts without a man’s approval. They rarely owned property. Many could not travel to banks or were not welcomed there if they could.

Yet when early microfinance institutions like BRAC began offering loans to women, repayment rates were around 98%. Households with women borrowers saw higher spending on food, education, and healthcare. In fact, studies show that women typically reinvest up to 90% of their income back into their families and communities, compared to 30-40% for men.

Clients became better able to manage irregular income, minimize risks, respond to emergencies, and save for the future. They also became powerful drivers of economic and social growth.

The solution: BRAC’s holistic microfinance approach

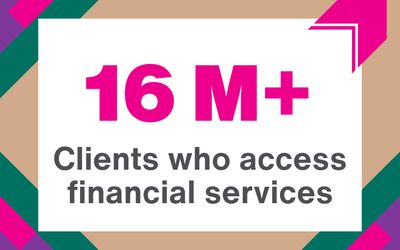

Today, BRAC is one of the world’s largest microfinance institutions. We currently serve 16 million people in 10 countries with loan, savings, and insurance products. About 96% of our clients are women. Many live in rural and hard-to-reach places.

While many other microfinance institutions focus solely on loans, BRAC takes a different approach. Because a loan by itself can help someone survive a crisis. But paired with the right training, services, and support, it can help someone build a long-term, profitable enterprise that uplifts their entire community.

BRAC’s model also includes:

- Training and skills: Each borrower receives basic financial literacy and business training. They learn how to budget, keep records, set prices, and plan for growth. These skills build the confidence needed to run a business successfully.

- Regular check-ins: BRAC staff visit clients regularly. They troubleshoot challenges, prevent clients from taking on too much debt, and offer mentorship. This support encourages success.

- Access to markets: BRAC connects clients to markets through programs like Aarong, which links rural Bangladeshi artisans to national retail markets. This larger ecosystem gives entrepreneurs the chance to sell more, charge more, and save more.

- Adaptation to the local context: Rather than a copy-and-paste approach, we tailor our model to the realities in each country we work in. For example, BRAC offers agriculture loans in Liberia with seasonal repayment schedules, so farmers pay after their harvest.

These innovations help clients to make the most of their loans, pay them back, and return as customers. About 80% of BRAC borrowers return for an additional loan, powering even more growth.

The impact in Bangladesh: how mobile money multiplied women’s power

Bangladesh is where BRAC began in 1972, and it remains home to one of the largest microfinance programs in the world. A typical client might take out a USD $250-$400 loan to open a tailoring shop, food stall, or livestock business. Along the way, she receives training, joins a savings group among her peers, and builds long-term financial habits.

In recent years, one of the biggest changes has been the rise of bKash, Bangladesh’s leading mobile money services platform. A joint venture with BRAC, bKash now has over 82 million users and has transformed how women handle money. They no longer need to travel long distances and wait in line to deposit, withdraw, or transfer cash. Payments are quick, transparent, and can be made at home, anytime.

Many women had never used a digital tool like bKash before. BRAC stepped in with community-based digital training. Women with no literacy were first taught letters and numbers. Those who had never held a phone before learned how to use the buttons. As a result, mobile money has grown tenfold in 10 years in Bangladesh.

A loan gives a woman a start at increasing her income. Digital access gives her more control over her earnings. Training helps her grow. With these tools, she can multiply her power.

They planted seeds. What grew was bigger than food.

"My future plan is to extend my life through agriculture, to make it big.” — Fatu Kamara, farmer in Montserrado County, Liberia. Watch how Fatu and two other farmers grew seeds into entire businesses… and find out what they did with their earnings.

The impact in Liberia: loans that multiply harvests and more

In Liberia, most families depend on farming for their livelihood. Yet farming is unpredictable, seasonal, and increasingly risky due to climate change. Women farmers face an even greater struggle to access capital, despite making up about 80% of the agricultural labor force.

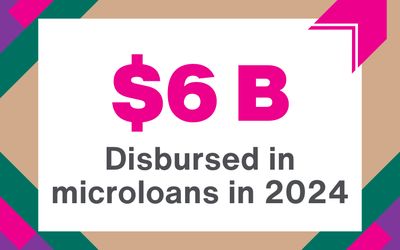

BRAC Liberia designed agricultural loans that include specialized training on crops, soil, and markets; seasonal repayment schedules; and support groups for farmers. With this model, maize and vegetable yields have increased significantly.

The big picture: investing in women erases extreme poverty

The math just makes sense. After accessing BRAC microfinance services, 95% of clients increase their earnings. Children’s nutrition and health improve. Education rates increase. Savings grow. Local economies strengthen. Entire communities rise from poverty.

Will you invest in a woman today? Your return will be real and measurable. You can be the spark that helps her unlock her entrepreneurial spirit and multiply her power for years to come. Give today and watch your impact grow.